A retirement plan that believes in your service and rewards you for your sacrifices.

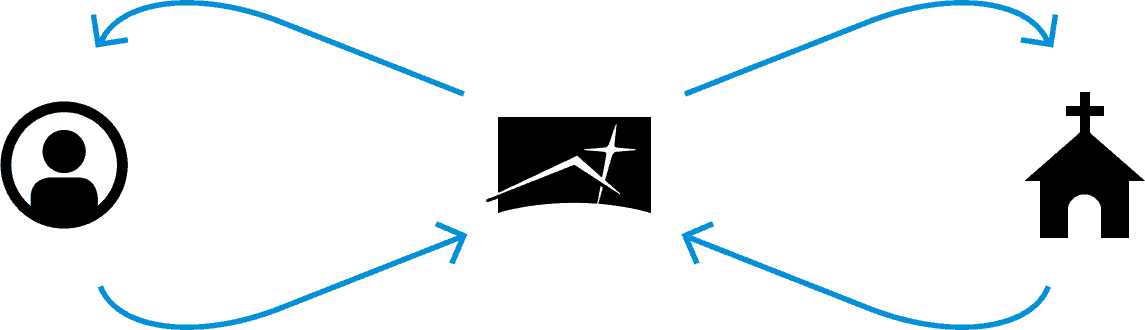

How it Works

Every dollar invested with CEP is assigned a mission — to empower ministry by funding church loans across the country. So while your retirement funds grow to benefit your family and future, they’re also used to enable Kingdom growth.

403(b) Investment Options

Our 403(b) ministers retirement plan is an employer-sponsored plan, available for qualified ministry staff of Assemblies of God ministries. With this plan, you’re able to deduct a portion of each paycheck and add it to your retirement fund with no taxes on your contributions or earnings until retirement. While you support ministry through your work, your retirement plan will empower AG churches and organizations around the country.

Benefits of our 403(b) retirement plan:

- Higher contribution limits mean you can save more each year. (Members under age 50 can contribute up to $23,000 or a 100% of their taxable compensation per year, instead of the $7,000 maximum for an IRA.)

- Your employer can make contributions on your behalf.

- The total annual contribution limit, including employer contributions and an over-50 make-up provision, is up to $76,500.00.

- If you retire as a credentialed minister, you may be able to designate a portion of your plan distributions as a housing allowance, which is tax-free under current tax law.

Our 403(b) plan also offers a choice of investments. Choose between our Vision Fund to build God’s Kingdom through loans to churches and ministries like yours. Or invest in mutual funds ranging in levels of aggressiveness. Click here to learn more about our 403(b) investing options.

Free Resource

Get your FREE copy of Minister Retirement: Bringing Clarity to Retirement Planning by completing the form below.

Free book available only to credentialed Assemblies of God pastors within the United States.